Links

Lots going on right now, so not many links this week, and I’ll definitely miss next week. Should be back on the 15th!

On the bright side, there’s some good stuff in here (the 2-star ones in particular are all better than average).

3 stars

Why is China smashing its tech industry? | Noahpinion

This is necessarily speculative, but this is a very interesting perspective:

China’s attack on its tech companies, in contrast, seems far more comprehensive — it’s not just attacking the biggest internet companies, it’s attacking the entire sector. For whatever reason, China is suddenly not a fan of the industry we call “tech”.

This is strange because for years, it was conventional wisdom in the Western media that having a “tech” sector was crucial to innovation and growth etc. In fact, for many years American pundits argued that China’s economy would be held back by the government’s insistence on control of information, because it would make it impossible for China to build a world-class tech sector! Then China did build a world-class tech sector anyway, and now it’s willfully smashing the world-class tech sector it built. So much for U.S.-style “innovation”.

But notice that China isn’t cracking down on all of its technology companies. Huawei, for example, still seems to enjoy the government’s full backing. The government is going hell-bent-for-leather to try to create a world-class domestic semiconductor industry, throwing huge amounts of money at even the most speculative startups. And it’s still spending heavily on A.I. It’s not technology that China is smashing — it’s the consumer-facing internet software companies that Americans tend to label “tech”. […]

If you’re interested in China and its economy, one analyst you should definitely read is GaveKal Dragonomics’ Dan Wang. And in Dan’s 2019 letter, I noticed the following passage:

I find it bizarre that the world has decided that consumer internet is the highest form of technology. It’s not obvious to me that apps like WeChat, Facebook, or Snap are doing the most important work pushing forward our technologically-accelerating civilization. To me, it’s entirely plausible that Facebook and Tencent might be net-negative for technological developments. The apps they develop offer fun, productivity-dragging distractions; and the companies pull smart kids from R&D-intensive fields like materials science or semiconductor manufacturing, into ad optimization and game development. […]

Dan’s job is to keep his ear to the ground, figure out what the movers and shakers in China think, and relay those thoughts to us. So when he started talking about the idea that consumer internet tech isn’t real “tech”, I immediately wondered if China’s leaders were thinking along the same lines. And then in his 2020 letter, Dan wrote:

It’s become apparent in the last few months that the Chinese leadership has moved towards the view that hard tech is more valuable than products that take us more deeply into the digital world.

2 stars

Imagining yourself as a digital person (two sketches) | Cold Takes

Does X cause Y? An in-depth evidence review | Cold Takes

A couple fun pieces from Holden Karnofsky’s (of GiveWell fame) new blog:

And one day, you get an email from your friend Alice, who has always been one of your most tech-enthusiast friends (she's usually the first person you know to buy some gadget). She's asking how you are and whether you'd like to catch up sometime. "I can't meet in person because I'm a digital person now :) But we could Zoom!"

So you do. She looks and sounds pretty much like herself on the call; her background looks like a normal bedroom. You have this conversation:

YOU: [out of politeness] So what was it like going digital? Do you like it?

ALICE: No regrets here! I just did the conversion a couple of weeks ago, I have to say I almost cancelled at the last minute because I just got freaked out about slicing up my brain. But I'm really glad I went through with it.

YOU: Slicing up your brain?

ALICE: Yeah, do you not know much about the procedure then? I mean they put you under anesthetic and then they literally pop open your head, pull out the brain, slice it up so they can scan it, and use that to create a digital you.

YOU: Doesn't that ... kill you?

ALICE: Doesn't feel that way to me. I showed up at the clinic, went into the operating room, got my anesthetic, fell asleep, and woke up on a beautiful mountainside with my chronic back pain gone.

YOU: A fake mountainside though right?

ALICE: No? It's like other mountainsides I've been to. And then I went into the local town, and got some food, and met some people.

YOU: But you're still talking about virtual reality. Your body, the one where they sliced up the brain - is that a corpse now?

There's an interesting theory out there that X causes Y. If this were true, it would be pretty important. So I did a deep-dive into the academic literature on whether X causes Y. Here's what I found.

(Embarrassingly, I can't actually remember what X and Y are. I think maybe X was enriched preschool, or just school itself, or eating fish while pregnant, or the Paleo diet, or lead exposure, or a clever "nudge" policy trying to get people to save more, or some self-help technique, or some micronutrient or public health intervention, or democracy, or free trade, or some approach to intellectual property law. And Y was ... lifetime earnings, or risk of ADHD diagnosis, or IQ in adulthood, or weight loss, or violent crime, or peaceful foreign policy, or GDP per capita, or innovation. Sorry about that! Hope you enjoy the post anyway! Fortunately, I think what I'm about to write is correct for pretty much any (X,Y) from those sorts of lists.)

Fighting Like Taliban | The Scholar’s Stage

Over the last month or so we have seen several reports out of Afghanistan registering the shock of the Americans, the Afghani government, and even the Taliban itself with the speed at which the Taliban forces have captured the Afghani countryside.

I am surprised with this surprise.

Orwell's "The Lion and the Unicorn" | Noahpinion

A brilliant, deeply flawed essay has lessons for modern times […]

George Orwell is known for his novels, especially 1984 and Animal Farm, but his nonfiction writing is essential reading. One of his longest and most interesting essays is “The Lion and the Unicorn: Socialism and the English Genius,” written in 1941. […]

This essay is interesting for multiple reasons. First, its main recommendation — that Britain should nationalize its industries — was either breathtakingly prescient or breathtakingly influential, since it was basically carried out by the postwar government of Clement Attlee. Whether Britain’s experiment with socialism was a result of taking Orwell’s advice, or whether (as is far more likely) it was simply a case of lots of people thinking along the same lines, I can’t say for sure. But in this essay you can definitely see the seed of the idea. […]

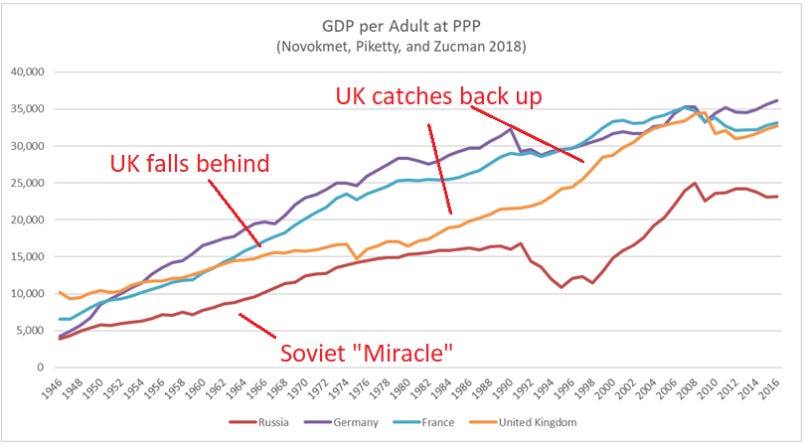

In fact, though Britain eventually took Orwell’s recommendation to nationalize a substantial portion of its industry (around 20%), this ended up doing little to make the country an industrial powerhouse, and may in fact have dealt a serious blow to the country’s living standards. […]

So “The Lion and the Unicorn” is a deeply flawed essay. Its confident predictions about the benefits of socialism for both economics and geopolitics were based more in starry-eyed idealism than in reality. But even so, the essay contains a large number of useful points and trenchant observations that can help us understand our own times.

For example, Orwell notes that the British socialists of his day had fallen into a sort of lazy anti-patriotism. He observes — quite correctly — that patriotism is a stronger, more deeply rooted motivating force than socialist ideology, and that even in the USSR people would primarily fight to defend their homelands. […]

In the U.S., anti-patriotism has become reflexive, almost de rigeur, on the political left. The traditional socialist opposition to American power abroad has merged with the new “woke” liberal consensus that America was founded on racism to produce something truly counterproductive to positive change. There are plenty of signs of this, from the near-glee with which some leftists recite litanies of the country’s problems as proof of its “unexceptionalism”, to the the lashing out against any and all symbols of the country.

There is no endgame for this sort of smug anti-Americanism.

It’s Easy to Borrow Money If You Have Money | Bloomberg Money Stuff

I’ve seen several pieces on this, but naturally Matt Levine’s coverage is the best:

You could have a dumb oversimplified model that goes like this:

In the olden days, rich people invested their money in stocks and bonds. They wanted cash flow from those stocks and bonds, money that they could live on without spending principal. So the stocks and bonds produced cash flows. Investment-grade bonds paid interest, blue-chip stocks paid dividends, and their rich owners used the interest and dividend payments to finance their lifestyles.

In modern days, rich people still invest their money in stocks and bonds, but they have discovered the concept of tax efficiency. Dividends and interest payments are taxable; if you have $100 million of wealth, it earns 5% a year in interest and dividends, and you pay a 40% tax rate, then in a year you will pay $2 million of taxes and be $3 million richer. You’d prefer not to pay the taxes.

So it is no longer particularly expected that good stocks will pay large, or any, dividends: Companies retain earnings to reinvest in growth (rewarding their shareholders with capital appreciation rather than dividends), or if they want to return cash they do it via tax-efficient buybacks rather than dividends.

Meanwhile the interest rates on bonds are really low. This is more of a macroeconomic thing than a tax-efficiency thing, honestly, but it’s worth noting.

If you have $100 million of wealth and it appreciates by 5% per year without paying out any cash, then in a year you will pay no taxes and be $5 million richer. Better!

How do you pay for your lifestyle? Well, if you have $100 million, you can pretty easily borrow money secured by your portfolio. If you borrow $3 million a year (what we assumed you were taking home under the old system) and your wealth keeps compounding at 5% per year, you will never borrow more than about 23% of the value of your holdings. A bank should be fairly comfortable lending you 23% of the value of your portfolio of stocks and bonds, since you’re rich.

Borrowing money is not income, so you don’t pay taxes on it.

And you’ll pay very low interest on this borrowing (see point 4).

It is just a more efficient way to extract spending money from wealth. (This model is sometimes called “buy borrow die,” because if you die in step 9, that can further improve the tax efficiency of the strategy.)

1 star

New Study Finds That Crows Are So Intelligent They Understand the Concept of Zero | My Modern Met

Zero is actually a rather recent mathematical invention. Many ancient number systems did not include a number conceptually equivalent to our modern-day zero. This fact makes the crow's newly discovered ability all the more impressive. Going into their experiment, the researchers at the University of Tübingen in Germany knew that crows have certain neurons which light up when they see certain quantities displayed. One dot fires a certain neuron, two another, three another, and four yet another. It was therefore already known that crows could distinguish these quantities from one another.

To test whether crows could comprehend zero as a numerical value, the researchers showed crows two displays of dots, each display containing between zero and four. The crows were trained to indicate if the two displays showed the same value. While they did this, researchers monitored their brain activity. When the crows saw “zero” dots, their brains fired a new neuron recognizing this new “quantity.”